Dave App Review: Simplifying Your Financial Management

Introduction:

In today’s fast-paced world, managing personal finances can be a daunting task. From tracking expenses to budgeting, it’s easy to feel overwhelmed. Fortunately, with the advent of financial management apps, the process has become more convenient and accessible. One such app that has gained popularity is the Dave App. In this article, we will provide an in-depth review of the Dave App Review, exploring its features, benefits, and overall user experience.

| Pros | Cons |

|---|---|

| No interest | Membership costs $1 per month to access cash advances |

| Offers advice on finding side hustles to earn extra money | Short repayment terms |

| Sends balance updates to protect you from overdrafts |

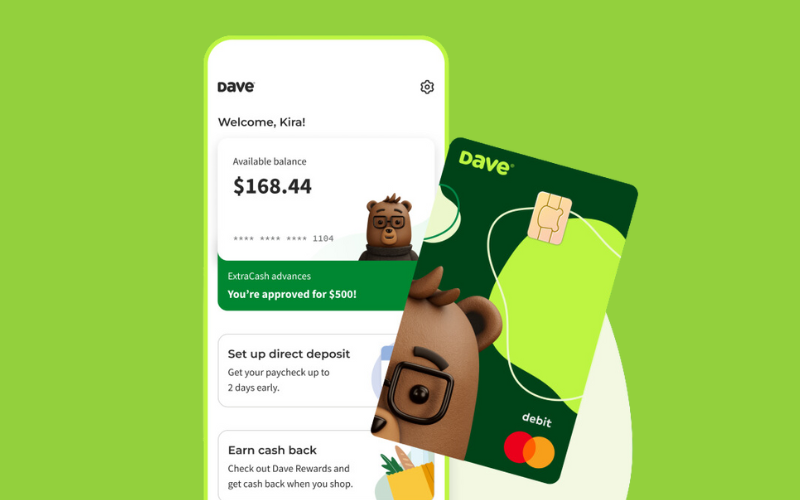

User-Friendly Interface:

One of the first things you’ll notice about the Dave App is its user-friendly interface. It is designed to be intuitive and easy to navigate, making it accessible for users of all tech-savviness levels. The app boasts a clean layout, allowing you to effortlessly find the features you need without any confusion.

Expense Tracking and Budgeting:

Dave App excels in its expense tracking and budgeting capabilities. It allows you to effortlessly keep track of your expenses, categorize them, and set budget limits for different spending categories. With real-time notifications and alerts, you can stay informed about your spending habits and make more informed financial decisions.

Smart Predictive Analysis:

What sets the Dave App apart from other financial management apps is its smart predictive analysis feature. By analyzing your spending patterns and income, the app provides personalized insights and suggestions to help you optimize your financial health. It can give you recommendations on how to save money, reduce unnecessary expenses, and even plan for future financial goals.

Overdraft Protection:

One of the standout features of the Dave App is its overdraft protection. In partnership with select banks, the app offers a unique service that helps users avoid costly overdraft fees. By connecting your bank account to the app, it can predict potential upcoming overdrafts and provide you with a small cash advance to cover them. This feature alone can save users significant amounts of money in fees and penalties.

Instant Cash Advances:

In addition to overdraft protection, the Dave App also offers instant cash advances. If you find yourself in need of some extra cash before your next paycheck, the app allows you to request a small loan instantly. The approval process is quick, and the funds are deposited directly into your bank account. This feature can be a lifesaver during unexpected financial emergencies.

Customer Reviews:

Dave has received positive ratings and reviews on various platforms. On the Google Play Store, it has an impressive rating of 4.4 out of 5 stars, based on more than 430,000 reviews. Similarly, on the Apple app store, it has a high rating of 4.8 out of 5 stars, with over 500,000 reviews. However, on the Better Business Bureau’s website, Dave has a lower rating of 1.19 out of 5 stars, based on nearly 300 reviews.

One of the positive reviews from the Apple app store highlighted that Dave did not charge any fees for repaying their ExtraCash™ loan at a later date. Another satisfied customer mentioned that they were able to access funds quickly and easily without encountering any additional fees.

On the other hand, a customer who left a negative review expressed their dissatisfaction with the varying and seemingly random borrowing limits associated with the ExtraCash™ feature. Another disappointed customer complained about difficulties in canceling their membership and continued charges despite their attempts to do so.

Fee-Free Banking:

Another notable benefit of using the Dave App is its fee-free banking option. The app provides you with a Dave banking account that comes with no hidden fees or minimum balance requirements. You can easily deposit your paycheck, make bill payments, and even set up automatic savings transfers. This fee-free banking feature can help you save money that would otherwise be spent on traditional banking fees.

Security and Privacy:

When it comes to personal finance, security and privacy are of utmost importance. The Dave App takes these concerns seriously, employing robust security measures to protect user data. It uses encryption protocols, secure servers, and follows industry best practices to ensure that your sensitive financial information remains safe and confidential.

Dave App Details

Eligibility:

- Dave does not require a credit check, but the amount you can receive depends on various factors, including your monthly income. The withdrawal amount may change on a daily basis, so if you don’t qualify for the desired amount initially, you can check again in a day or so.

Withdrawals:

- Not everyone will have access to the ExtraCash™ feature. To utilize it, you need to link your bank account and then open the Dave app to determine if you qualify for an ExtraCash™ advance. You may need to answer additional questions to complete the withdrawal process.

Interest and Fees:

- Dave does not charge interest, but there might be a fee depending on the type of transfer. For express transfers to a Dave account, fees range from 99 cents to $6.99. If you use an external account, the fee will be between $2.99 and $11.99. The transfer fee is based on the requested amount, and there are no fees for standard transfers.

Additionally, Dave users have the option to leave a tip, although it is not mandatory. The ExtraCash™ feature aims to provide a more affordable alternative to traditional payday loans.

Customer Support:

Dave App provides excellent customer support to its users. Whether you have a question about a specific feature or need assistance with a transaction, their support team is readily available to help. You can reach out to them via email or through their in-app messaging system. The prompt and helpful responses from their support team contribute to an overall positive user experience.

Conclusion:

In conclusion, the Dave App is a powerful tool that simplifies financial management for individuals. With its user-friendly interface, expense tracking, budgeting capabilities, smart predictive analysis, overdraft protection, instant cash advances, fee-free banking, and robust security measures, the app offers a comprehensive solution for personal finance management. Whether you’re looking to gain better control over your spending or save for future goals, the Dave App can be a valuable companion on your financial journey. Give it a try and experience the convenience and peace of mind it brings to your financial life.